NAIOP Massachusetts remains committed to addressing the serious ramifications of climate change, and we look forward to working with policy makers to move forward practical, feasible initiatives. However NAIOP continues to oppose technologically unattainable and impracticable proposals. The below article, written by Andy Metzger, originally appeared in the online edition of CommonWealth Magazine on December 8, 2019.

An arcane state board, known to few outside the world of design and construction, is the setting of a furious clash the outcome of which could influence the amount of climate-curdling emissions that pour out of chimneys, as well as the future supply of housing in Massachusetts, where affordable homes are already scarce.

The Board of Building Regulation and Standards might seem an odd venue for the drama that has unfolded there. The BBRS adopts and administers the statewide building code and the building energy code, sets of rules that are important but would bore the average reader to tears. It is the domain of professionals who think in cubic feet, seismic loads, and kilowatt hours. Now, the problems of the world are before it.

While much attention has been focused on reducing emissions from power plants and cars, commercial, residential, and industrial buildings in Massachusetts collectively spew more greenhouse gases into the atmosphere than either the power or transportation sectors. Commercial and residential buildings in Massachusetts emit about as much harmful gas into the air as the entire transportation sector.

That’s leading activists like Dr. Gaurab Basu, a Somerville physician who says the climate crisis will ultimately produce a public health crisis of increased deaths and hospitalizations, to insert themselves into the byzantine world of building codes. “As a parent of two young children and as a physician, I’m deeply concerned about this. I realize that the crisis forces us to do things that feel uncomfortable, to be pushing at a scale that feels like it’s untenable, but that’s the situation we’re in,” Basu told the board at its November meeting.

Climate activists like Basu, who have paid careful heed to the dire warnings of the world’s scientists, have pressed the BBRS to put out a net-zero energy code. The idea is that under a more stringent code newly constructed and newly renovated buildings would produce virtually no greenhouse gases, notching a small but meaningful victory in the worldwide campaign to avoid a climate catastrophe. That could be accomplished with tighter construction, energy efficient appliances, on-site renewable energy generation such as solar roofs, or under certain circumstances, a financial arrangement to procure renewable power from off-site.

Real estate agents and some builders are strongly opposed to the net-zero campaign, arguing that piling new requirements on top of existing construction costs would grind development to a halt, squeezing home prices, and exacerbating the region’s affordable housing crisis.

“We encourage an energy-efficient code, but we need to go where it makes sense from a cost standpoint and a technology standpoint,” said Tamara Small, CEO of NAIOP Massachusetts, which represents commercial developers. “We may get there, but we’re not there yet.”

Because of the schedule for adopting new building codes in Massachusetts, which statutorily follows the issuance of the International Energy Conservation Code, the big decision over whether to include a net zero code in that update won’t come to a head for another couple years – probably 2021 at the earliest. But environmentalists and business interests have already begun to skirmish and jockey for position.

Click here to read the sidebar.

Meanwhile, activists are making other plays at the local level to try to cut down on climate pollutants. In late November, Brookline’s town meeting adopted a bylaw to prohibit the installation of oil and gas pipes in new construction and renovations, which would give the market a big shove toward electrical appliances and home-heating systems. It was the first municipality to take that step. All town bylaws must undergo a review by the attorney general’s office to see whether they align with state laws and the constitution, so opponents still have a chance to kill the policy. Arlington town manager Adam Chapdelaine said on Twitter that depending on how the attorney general rules, he would be interested in trying the same sort of thing in his town.

From a global perspective, environmental initiatives undertaken so far have failed to slow – much less reverse – the output of greenhouse gas emissions into earth’s atmosphere. For the past decade, emissions have grown 1.5 percent annually, and emissions must drop sharply over the next decade to avoid the worst ravages of climate change, according to the latest United Nations report. The blight, disease and flooding that unchecked climate change will unleash is all the more reason, according to advocates, to take the necessary steps in Massachusetts to significantly reduce the amount of greenhouse gas that seeps out of our homes and workplaces.

BOARD MEETING SHOWDOWN

The Board of Building Regulation and Standards is nestled under several layers of government bureaucracy. It is contained within the Division of Professional Licensure, which is an agency of the Office of Consumer Affairs and Business Regulation, which is itself a component of the Executive Office of Housing and Economic Development, whose secretary, Mike Kennealy, serves at the pleasure of Gov. Charlie Baker.

The 11-member board is presided over by John Couture, who doubles as the town of Sutton’s building inspector. Couture, who decline an interview and said he doesn’t talk to any news reporters, will see his term come to an end December 31. Couture will remain on the board, which will elect its next chairperson, according to a spokesperson.

The BBRS holds its monthly meetings all over the state. When in Boston, it generally uses a conference room in a non-descript state office building across the Massachusetts Turnpike from Chinatown. That is where the board convened on a Tuesday in early November for a session where net-zero proponents and opponents each warned of a calamitous future.

Over the course of several hours, members of the public alternately pressed the board for stricter environmental standards to avoid a complete environmental collapse, or cautioned against rash action that could further balloon housing costs or threaten the chimney and fireplace industry. Couture and other board members listened respectfully to some of the testimony, but they were at times dismissive or skeptical of environmentalists pitching the net-zero idea.

Jacob Knowles, director of sustainable design at BR+A, a national engineering firm, told the board that net-zero building makes for cheaper and healthier living spaces, and his firm found that making buildings net-zero adds less than 1 percent to the construction costs. To buttress his case, Knowles unfurled a letter signed by roughly 1,500 people and 80 companies, including prominent architecture firms, calling for the development and adoption of a net-zero code.

“Take that with you,” Couture replied curtly, after Knowles displayed the letter on the table. “We don’t want your prop.”

Board members also occasionally debated with commenters, questioning the philosophical underpinnings of their advocacy.

“There are a lot of developers that will do the code minimum, period. Period. So we need to raise all boats,” argued Jim Stanislaski, an architect for the international firm Gensler, who supports creating a net-zero code. “And incentives are great; carrots are great. But we need to move out of the voluntary into the compulsory.”

To Michael McDowell, a board member and homebuilder, that sounded like an indictment of people’s intelligence.

“The more we regulate, the less we give citizens of Massachusetts an opportunity to make a choice,” McDowell said. “In other words, you’re almost saying to the citizens, ‘You’re too stupid to make the right choice so we’re going to make it for you. Congratulations.’”

Stanislaski protested that he wasn’t calling people stupid. Then Couture jumped in to question what would happen if the highest standards were used for structural integrity and fire protection requirements – as opposed to energy efficiency.

“If we started saying, you know what, ‘We think that we should have 200-pound roof-loads, just because it’s good,’” said Couture. “There are ramifications for that.”

To deal with these knotty issues, the board had tasked its Energy Advisory Committee – which is made up of other building professionals and engineers – to “show us what net-zero looks like,” according to Couture. But around the same time, the board changed the composition of that committee so that it tilts more toward the views of the construction industry. In October, the board decided to add three contractors to the advisory committee and remove spots designated for a utility representative, an indoor air quality expert, and an appliance expert.

To those hoping to push the state towards a net-zero code, the committee shakeup seemed part of a strategy to thwart that effort.

“It seems like a big shift to say, ‘Take off some of the energy experts and put on contractors,’” said Knowles in an interview. “At face value, that screams to me of trying to shift the whole dialogue towards a more conservative solution.”

A discussion about the shakeup raised hackles among board members during their November meeting when member Richard Crowley suggested that “people on the ground know more about what’s going on” than architects or engineers who rely on books.

“Just stop. Really stop,” board member Kerry Dietz, an architect, interjected. “It is insulting to those of us who are professionals.”

According to Couture, the shakeup was based on a directive from Division of Professional Licensure commissioner Diane Symonds, who wanted more input from “stakeholders.”

“Just because we added three contractors doesn’t mean we added three villains,” said Couture. “We added people that are actually building this stuff.”

Couture also expressed his irritation at an email circulated about the advisory committee issue that he said was “mean” and attacked the board’s integrity. Couture appeared to have been talking about a missive from the Massachusetts Climate Action Network encouraging people to attend the November meeting. While that email criticized the board’s changes to the advisory committee as a “big step backwards,” it did not suggest ulterior motives or make any overt attacks on the board’s integrity.

Advocates on both sides of the issue will have plenty of time to hone their arguments. Under a 2008 state law dubbed the Green Communities Act – which was one of Deval Patrick’s signature environmental accomplishments as governor – the state must meet or exceed the standards of the International Energy Conservation Code, which is developing an update for 2021. That would present the next obvious opportunity to push for a net-zero code.

WHAT WOULD NET-ZERO MEAN?

Net-zero construction is already happening in Massachusetts, and the principle of a net-zero code is pretty straightforward: eliminate the carbon footprint of buildings by enhancing their efficiency and using renewable energy sources for all power. But advocates are fuzzy on the details. As of November, only the American Institute of Architects had submitted a fleshed out proposal to the BBRS.

The AIA plan would give builders a couple of options to determine a building’s energy needs either through a formula or by measuring the building’s actual energy performance. Then the AIA plan would require a corresponding amount of renewable energy generation either installed on-site or procured off-site. The AIA net-zero plan would apply to new commercial, institutional, and mid-level or high-rise residential buildings.

There is one big complication with applying a net-zero standard to urban development. Residential towers and commercial skyscrapers don’t have enough space on their roofs to provide solar power to all the floors below.

“High rise is extremely challenging,” said Stanislaski, the architect who supports shifting to net-zero.

One irony is that high rise developments can help reduce carbon emissions in the transportation sector, especially if they are near transit, because they tend to make neighborhoods denser and more walkable.

It’s not impossible to build a net-zero skyscraper. Solar power and wind energy can be procured off-site, and under the current mix of government incentives, it can even be cheaper than using fossil fuels, according to Knowles, who acknowledged that a renewable energy requirement presents new risks for developers.

“They want to minimize risk, so if there is any potential volatility, they want to avoid that, but I don’t see how that supersedes the need to address climate change and minimize our carbon footprint,” Knowles said.

Small, the NAIOP Massachusetts CEO who represents commercial real estate developers, has a bleaker view on what sort of effects a net-zero standard could exert on the marketplace.

“When you then talk about adding on something that makes a building zero net-energy, it’s going to be cost-prohibitive, so nothing’s going to be built. The numbers simply don’t work. And I don’t think when we have a housing crisis that really is necessarily the best approach,” Small said. “I think we have to proceed with caution because the unintended consequences could literally be no new commercial office space, lab space, retail, multi-family, mixed-use, you name it.”

Other areas with high housing costs have pushed the construction industry towards net-zero standards. California has instituted new requirements and set goals to phase-in net-zero construction for new and existing buildings over the next decade. New York is taking a number of steps to encourage net-zero developments and retrofit existing buildings to make them more energy efficient.

Massachusetts has made significant strides in energy efficiency. For nearly a decade, the Bay State has earned top marks from the American Council for an Energy Efficient Economy for its policies, including the relatively stringent measures adopted by the BBRS.

But given the scale of threat posed by global warming, many believe more should be done, and Knowles said the changes needed in construction are well within reach.

“This is not pie-in-the-sky. This is not some sort of dream fantasy idea. This is something that we’re doing consistently now on large, complex urban and non-urban projects,” Knowles said. “I have not come across a project that cannot achieve these goals, and in every single case we’ve been able to prove it’s cost-effective.”

Credit: Elisif Brandon

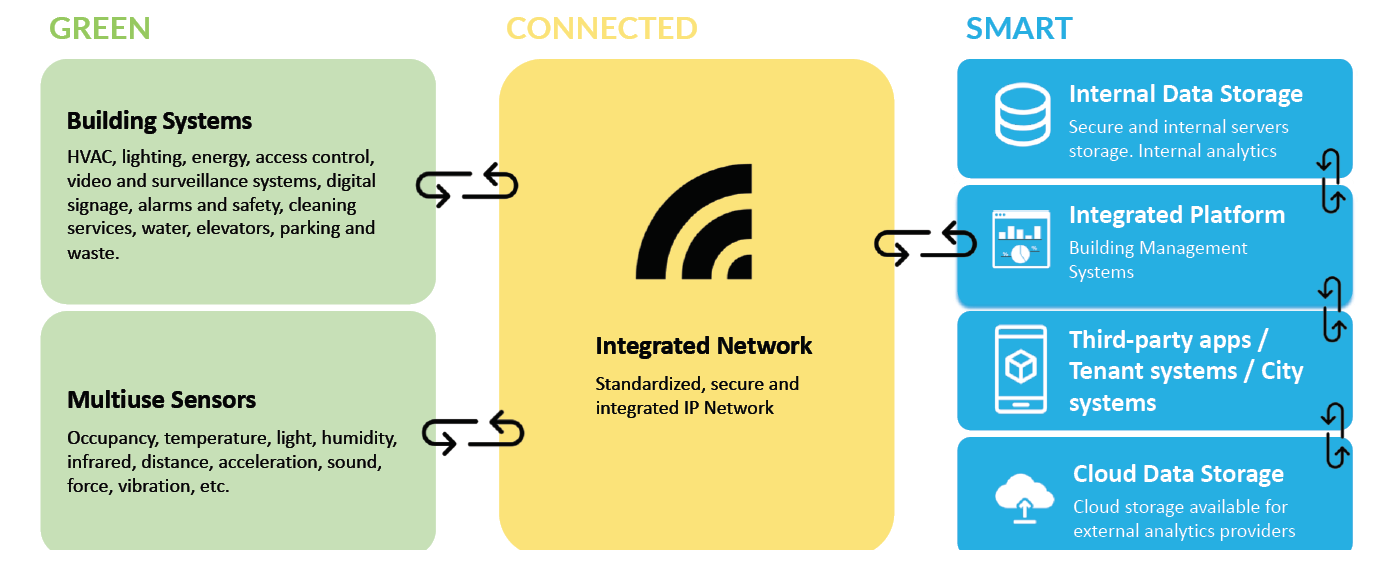

Credit: Elisif Brandon Courtesy of the MIT Center for Real Estate and Real Estate Innovation Lab –

Courtesy of the MIT Center for Real Estate and Real Estate Innovation Lab –  This post was submitted by T.J Winick, Vice President at

This post was submitted by T.J Winick, Vice President at