I came to Tokyo expecting to find an aging office stock with little new construction and extremely high vacancy rates. I am surprised to report that not only are there magnificently designed, new, mixed-use projects, especially in the Shiodome area, vacancies are at levels that would make us envious. It turns out that vacancy rates in the 7% range (including the older stock) are considered dangerously high. Historically, rates have been under 4% in the Tokyo prime markets, only rising in response to major global impacts like the “dot com bubble” or the recent recession started by the U.S. subprime mortgage crisis. Curiously, real rents have not grown that much. With vacancies like this in Boston, rents would be spiking. Clearly, it’s a different economy!

Category Archives: Economy

Grim Optimism for Real Estate and the Economy

Goodwin Procter’s Real Estate Capital Markets Conference was recently held in New York City in partnership with Columbia Business School.  An exceptional group of speakers discussed the real estate markets, investments, and the economy.

An exceptional group of speakers discussed the real estate markets, investments, and the economy.

The keynote presentation was delivered by Austan Goolsbee, former chairman of President Obama’s Council of Economic Advisers, and now a Professor of Economics at the University of Chicago’s Booth School of Business. Goolsbee spoke with “grim optimism” about the US economy. The US has the most productive work force in the world and low energy and new-energy sources will benefit our growth. Relative to the rest of the world, our fiscal imbalance is manageable. All in all, he believes that the next six to twelve months will be a bumpy ride, but prospects in the long-run look good.

The following are a few interesting observations made during the panel discussions:

- Demographics are playing a key role internationally, especially in the US. Effects of this will be seen in an increased demand for apartments, senior housing, and retail.

- With accounting standards likely to change in the future, as relating to corporate leasing and ownership, more businesses will likely choose owning large amounts of their space.

- Retail sales continue to be impacted by online competition, but retail is still a growing market. The future may move towards more hybrids that have both online and storefront locations.

- Office space needs are dropping in terms of space requirements per new job. However, there is a sense that over time businesses will start to swing back towards a need for greater space.

- Multifamily housing rents are back to pre-recession highs and it is likely that rents will experience slower growth going forward.

- Record amounts of capital were raised both in the public and private markets last year. With less growth worldwide, real estate is very attractive to investors. Investor interest is focused on yields and risk management. Where in the past, “cash is king”, now, “cash flow is king”.

- Rates should not be rising in the short term, but that is a big risk for all asset classes. The markets could wake up to a starting spike in rates that, in hindsight, will have seemed inevitable.

Hurricane Sandy’s Message for Boston

A recent Boston Globe Editorial, “After a near-miss with Sandy, more preparations are needed,” advocated for policy makers to focus on climate adaptation measures to protect Boston from future storms and flooding. NAIOP wholeheartedly supports convening public and private interests to discuss short-term and long-term solutions that are practical and feasible.

An important first step would be to create incentives for building owners and developers that would make climate change planning part of their design process. Focusing on carrots instead of sticks will be an important first step in changing the way some in the industry view this issue. As an example, we should be encouraging, not penalizing, the relocation of utility spaces to upper floors. This relatively simple step would have preserved many of the systems that were destroyed in New York and New Jersey. However, current codes do not exempt these areas from the allowable building envelope, causing landlords to worry about losing rentable space to mechanical equipment. A change should be made that would provide additional square footage for those developers that commit to doing this.

The Globe editorial suggested that restrictions be put on ground-floor uses in areas that will be prone to flooding. However, as with the scenario above, it is critical that the impact of decreased rental income and increased construction costs be mitigated. Furthermore, some of our current laws would prevent such a policy. As an example, our Chapter 91 statute mandates the use of the first floor space for public access.

Yes, we need to find ways to efficiently prepare our coastal cities for the increased frequency of powerful storms, but we should also be ready to adjust our policies to incentivize the public and private sectors to make appropriate infrastructure and building redesigns, not penalize them with red tape and unnecessary costs.

Optimism: the way to start your day

This post was written by Kimberly Sherman, and originally appeared on the Nickerson PR blog, CheersLive!

On Thursday November 29, 2012, over 400 attendees gathered at the Seaport Hotel Boston for the NAIOP/SIOR Annual Market Forecast, one of the industry’s leading market forecasts. Nickerson PR was the sponsor of the much-anticipated event. “Being knowledgeable as a peer in the field, helps Nickerson PR to provide a better service to our clients – we want to be a knowledgeable business partner to every client – not just a vendor. It was very important to sponsor such an event,” said Lisa Nickerson, Principal of Nickerson PR and Board Member SIOR New England.

Barry Bluestone, Dean, School of Public Policy &

Barry Bluestone, Dean, School of Public Policy &

Urban Affairs at Northeastern University

David Begelfer, CEO for NAIOP Massachusetts moderated the program. The Keynote speaker, Barry Bluestone, Dean, School of Public Policy & Urban Affairs at Northeastern University, offered an optimistic and timely economic snapshot of our local real estate market. Bluestone’s economic overview mostly centered on why we will return to a 0.2% growth rate. He outlined six things we haven’t paid enough attention to.

1. The demographic boon is over

2. The plateau in educational attainment

3. Increase in inequality

4. Globalization and outsourcing

5. Energy and environment

6. Twin deficits

In closing, Bluestone firmly stated that to avoid this path, we would need major innovation and investment for large-scale ideas. He reminded us that the good thing is the US has accomplished this before, so we should have the confidence that we can do it again.

Some of Greater Boston’s most active real estate professionals presented an analysis of the Massachusetts commercial markets, with a special look at the office, industrial and capital markets. Panelists discussed the drivers and fundamentals behind 2012 statistics, including emerging trends in specific markets, new growth areas and a general outlook for the future. Among these market experts were:

- Industrial: Catherine Minnerly, Executive Vice President / Partner, NAI Hunneman

- Suburban: Duncan Gratton, Partner, Cassidy Turley FHO

- Cambridge Office: David Townsend, Senior Director, Cushman & Wakefield of Massachusetts, Inc.

- Boston Office: Kristin Blount, Senior Vice President, Boston, Colliers International

- Capital Markets: Frank Petz, Managing Director, Jones Lang LaSalle

The majority of attendees I spoke to were pleased to leave the event with a feeling of optimism. In the words of market expert panelist Petz, “Boston is hot, we are lucky to both live and work here.”

Some take-aways from NAIOP Forecast attendees:

“It’s always great to hear lots of optimism about the direction of the commercial real estate markets for 2013 and beyond. Absorption rates are increasing significantly throughout the region which bodes well for the CRE market for years to come.” Bud LaRosa, Chief Business Performance Officer, Tocci Building Companies

“It was refreshing to hear Barry Bluestone speak to overcoming the fiscal cliff and offer insight as to why there is plenty of good news ahead for the real estate market.” Merrill H. Diamond, Founding Partner of DIAMOND SINACORI, LLC and IGNITION Residential, LLC

“With 7,500 new multi-family units planned and Boston supporting the effort, it’s nice to be assured that Boston real estate is hot right now.” Markell Blount, Partner, Sparta Consulting Inc.

“I am happily surprised by the level of optimism expressed today. The last few events have been more doom and gloom, so I’ll take this news any day.” Mark Glasser, Principal, Packard Design

Kids Are Not Toxic Waste

There have been many studies on the state of housing in the Commonwealth. What is very clear from these, and the numerous opinion pieces on the subject, is that we have very high barriers to the development of housing in general, and affordable and family housing, in particular. What is also apparent is that the economy cannot fully recover without the support of highly talented, college graduates that continue to leave the state.

Paul McMorrow wrote a column in The Boston Globe on April 24th that lays out the problem. Massachusetts has not been able to keep up with the current housing demand. This results in slower job creation and volatile housing prices. As Paul points out, without sufficient supply, the recovery is going to result, once again, in an explosion in housing prices. According to a report by the Donahue Institute at the University of Massachusetts, if the current pace of development is maintained, there will be a deficiency in our housing stock of 46,000 units. We are already seeing this problem with an inadequate rental stock, driving rents to record highs.

The problem is rooted in several areas that include “home rule,” large lot requirements, lengthy permitting, frequent appeals, and an anti-children attitude.

- The economic needs of the Commonwealth have been stymied by local regulations that continue to encourage large, expensive homes and discourage the production of more affordable “starter” housing.

- With minimum lot requirements in many towns of 1-2 acres, it is very difficult to economically justify building smaller scaled homes. (Few of these municipalities even offer cluster zoning.)

- Permitting requirements have become more onerous with local rules and special by-laws making the development process longer and more unpredictable.

- Even with local approvals, there are the frequent appeals that delay the start of a project by 1-2 years (sometimes effectively killing the project.)

- Lastly, many housing proposals that would attract families with school age kids are denied at the local level. The often heard justification is that adding any number of children to the system will break the back of the school budget. Oddly, this argument occurs in communities that project future reductions in the school age population. Frequently, it seems that communities would be more welcoming to an asphalt batching plant than to new children.

As Paul McMorrow so eloquently states, “The state’s technology sectors demand steady supplies of young talent. But over the last decade, while the Massachusetts population was growing at a meager 3-percent clip, it lost 9 percent of its 25- to 34-year-olds. These are the recent college graduates and young families that the state’s economic future is built on. They’re also the population that’s most sensitive to the state’s deeply ingrained affordability crisis. And they’re voting with their feet.”

Our future is our young families and our children. It’s time we stop viewing children as the equivalent of toxic waste and start building the housing we need. Otherwise, we will only have ourselves to blame for a failed economy.

If You Build It, They Will Come: Demand Exists for More Multifamily Housing in Greater Boston

A recent article in The Boston Globe talked of the recent surge in apartment construction, identifying 11 developments either under construction or about to receive final approvals. Although not as many, there are also large multifamily projects underway in the suburbs, including John M. Corcoran’s development in SouthField (the former Weymouth Naval Air Base) that Rick High described at NAIOP’s recent lunch program.

Some skeptics believe that the weak economy and high supply will result in an oversupply of multifamily housing. I disagree. There is no doubt we have room in the market for quite a few more projects, both in Boston and the surrounding communities.

Since the recession began in 2009, the vacancy rates for rental housing have plummeted and, not surprisingly, the rents have pushed upwards. Boston now has one of the lowest vacancy rates in the country. With higher rents and interest rates remaining historically low, new multifamily developments are finally viable. Though the costs of housing production in Massachusetts are still among the highest in the nation, due in part to labor costs, these projects are profitable (by some rather thin margins, though.)

If you believe the increased demand is only due to the burst of the single family housing bubble and the resulting foreclosures, you need only look at the other drivers in this area. The research firm REIS has reported that the net absorption in this market is the highest on record since it started tracking the data in 1980!

As reported by Cushman & Wakefield, there are a number of factors contributing to the growth of the rental housing market in the Boston area:

- Job Growth: With a conservative 35,000 jobs a year projected to be created, there will be an additional 35,000 households over the next 5 years;

- Change of Ownership: 87,000 rental households are needed to fulfill the demand created by the shift in ownership from single family to rental;

- Increase of Echo Boomers (ages 21-34): 27,000 rental units are needed to satisfy the demand created by this generation. Approximately 75% of this population are renters and this demographic is expected to grow by 2.2% over 5 years.

Bottom line – that’s a lot of demand! And even with all of the construction planned, the vacancy rate is still projected to drop. Certainly good news for developers and the Massachusetts economy!

Filene’s Site Back in Play?

In today’s Boston Globe, it was reported that Peter Meade, Director of the BRA, indicated a willingness to work with the REIT, Vornado, to move forward on the stalled Filene’s Franklin Street development. This is good news for the Washington Street corridor and the city.

The reality is that the problem with this project has never really been the developer; it has been the deep recession that put a freeze on all speculative commercial development in the country. There was a thought that the city could permit a downsized project for a new buyer. The problem with that is two-fold. First, it was unlikely from the start that Vornado was going to sell the site at a deep discount. They are not being pressed by a lender to sell –it’s their own money sitting in this hole (all $200 million of it!) Secondly, the city would be shorting themselves of substantial real estate taxes that would have eventually come from the office and hotel towers when the market returned.

This location is a premium one and when office vacancies start to fall and rents rise, this will be one of the first sites to see a crane. In the meantime, there is demand for retail, parking, and apartments. It sounds to me like the approval for a phased project allowing for a future tower could be a win-win for the city and the developer.

Let’s just hope the talks continue.

Massachusetts Needs Regulatory Reform to be Competitive

A MassBenchmarks report from the University of Massachusetts shows the national economy grew by 3.2 percent in the 4th Quarter of last year, while the state’s grew by only 1.8 percent. This comes after a stellar performance in Massachusetts with the local economy and job growth outpacing the nation since the 4th Quarter of 2009.

The take-away from this is something we already knew: Massachusetts is a unique place, but we are not so special that we can coast our way to recovery ahead of the nation. Although this may be an economy “pausing to catch its breath,” as the report suggests, the real risk is that just like the recession of 2000, we end up falling short.

Consider this a wake-up call. We cannot afford to be complacent; we must go on the attack, doing everything in our power to make this region more competitive, more business friendly, and more efficient.

If we are to be truly competitive, we must confront the cost of doing business in Massachusetts. This includes the direct costs of operations (taxes, fees, insurance, utility costs), but also includes indirect costs of time and resources necessary to comply with the complex, multiple layers of regulations, policies, rules and guidance affecting all employers throughout the state.

With fewer resources available, now is the time for government to do more with less. We must be more efficient with resources within our regulatory agencies, and we must allow businesses to focus on job growth rather than wasting time managing redundant and often-outdated or ineffective regulations and rules. For many years, cost-benefit analyses have been required of all agencies for new regulations, but this has never been taken seriously. The attitude seems to be that businesses are “lucky to be here” and can easily afford any regulatory imposition placed on them. Government has the responsibility to protect the public, but to ignore the costs and the impacts they have on the economy is not protective of a public that is dependent on job revenue to fund its operations.

Things are improving, however. In Governor Patrick’s second inaugural speech, he specifically mentioned this issue and the importance of job growth. During the past 18 months, the Governor and his agency heads took a top-down review of new regulations, and we applaud them for that effort. Now we call upon them to go further by reviewing our existing regulations to ensure that they are doing the job that they were intended to do; that they are consistent with the statutes authorizing them; that they are the most cost effective and efficient means to their goals; and that there are not better ways to accomplish what they do (e.g. privatization or self-certification).

We may never be the lowest-cost state, but let’s develop the reputation of being a state that understands the needs of business and works actively to make interactions with government as smooth and cost effective as anywhere else.

Boston Federal Reserve President Eric Rosengren Speaks at NAIOP Event

This morning, Dr. Eric Rosengren, President and Chief Executive Officer of the Federal Reserve Bank of Boston, provided the keynote address at NAIOP’s well attended and informative program, “Banking on Real Estate: Capital Flows and the State of CRE Lending.”

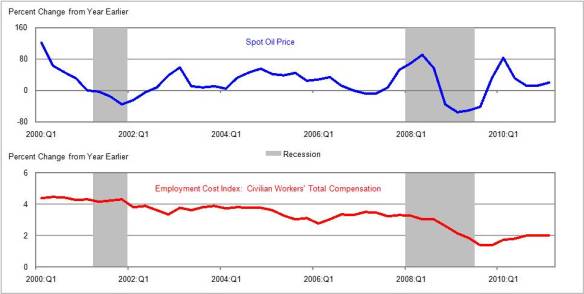

As a result, until there is progress on the Fed’s mandates of stable prices and employment, he believes that the current Fed accommodative monetary policy is appropriate. For now, there is no reason to slow the economy down with a tighter monetary policy.

That said, he indicated that the Fed would, most likely, take decisive and forceful action if inflation expectations start to rise.

Based on Dr. Rosengren’s comments, I would say that all indications are that this period of historically low interest rates will continue for the foreseeable future. This is probably good news for current commercial real estate owners that are worried about the FDIC’s eventual implementation of a “mark to market” policy. Having to refinance property, with falling rental revenue, would be all the more difficult with rising interest rates. On the other hand, investors sitting on a lot of cash on the sidelines may still be sitting for a while longer.

Good News in the Debt Markets

We have come a long way since the “depression” of 2008. For real estate, lending all but dried up and many loans were being called in (some are still in jeopardy.) But times are changing. For the right borrower, for the right real estate, money is available from a number of sources and competition for deals is back (with some caveats.)

According to lending guru George Fantini’s Key Trends from the First Quarter 2011 Lender Survey, the recently moribund conduit market (securitized lenders) is back for projects with good cash flows. According to him, the number of credible originators has doubled to 20 with 10 year loans in the mid to high 5’s (lower with 5 year terms.) However, unlike the other lenders (banks and insurance companies who offer terms up to 30 years for $2-30mm loans), they are only interested in the $10mm plus market. The trade off is that the conduits are not as conservative when it comes to underwriting, although big banks have been talking about 75% loan-to-value ratios (up to 80% for apartments).

Insurance companies are offering rates from the upper 4’s into the 6’s depending on the loan term (the shorter the term, the lower the rate.)

However, be prepared to sign personally for these loans, unless you are dealing with a high quality product (like apartments) or are willing to lower your loan-to value ration substantially.

But the good news is that debt is back and the world of real estate is starting to normalize. That won’t completely happen until we see some serious increases in employment and corporate/personal spending.